#CryptoExplained: Crossing the Chasm: U.S. Bitcoin Spot ETFs Usher in a New Era of Crypto Adoption

As the cryptocurrency landscape evolves, the relationship between Bitcoin and Ethereum will undoubtedly be compelling to observe

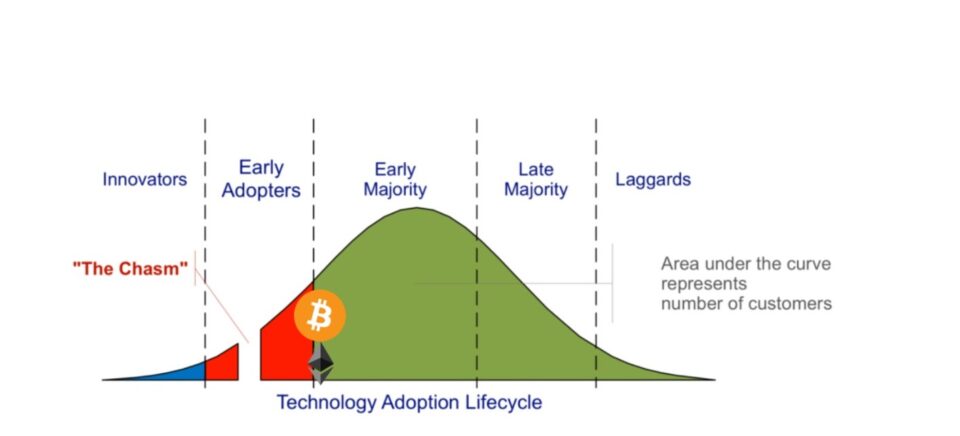

The introduction of US Bitcoin spot ETFs marks a pivotal moment in the journey toward cryptocurrency acceptance. In an earlier article, I emphasized the significance of the product adoption curve. With the United States Securities and Exchange Commission (SEC) approval of the US spot Bitcoin ETFs, it is evident that crypto has successfully navigated the chasm phase of the curve and is now entering the realm of the early majority. On average the gains of new entrants forming the early majority, will likely be less than those of the early adopters, but they will still beat the broader market as adoption of crypto continues to increase.

Anticipations are high that, over the coming months, traditional investors will channel substantial funds into the cryptocurrency market via spot ETFs and derivatives. This influx is expected to lead to a steady increase in cryptocurrency values. Additionally, the impending Bitcoin halving in April is poised to further fuel this upward trend by slicing the daily supply of Bitcoin in half.

Yet, it’s Ethereum that seems poised to reap the most significant rewards from the Bitcoin ETF approvals. As the second-largest cryptocurrency by market capitalization and the premier protocol in terms of total value locked, Ethereum has experienced more substantial gains than Bitcoin since the ETF approvals. Several factors contribute to this. Firstly, Ethereum is expected to benefit from the Bitcoin halving and the anticipation surrounding the forthcoming Ethereum ETF in May. Secondly, Ethereum’s inherent utility as a smart contract platform, its capped supply, and ongoing enhancements aimed at boosting its efficiency and accessibility, position it as the preferred infrastructure for global digital assets.

Looking ahead, the Ethereum ETF, expected to launch in May, is set to solidify Ethereum’s status as a frontrunner in the digital asset sphere. This ETF will draw in conventional investors seeking diverse exposure in the cryptocurrency market and spotlight Ethereum’s distinct features, such as its smart contract functionality and progressive upgrades aimed at improving scalability and performance.

As the cryptocurrency landscape evolves, the relationship between Bitcoin and Ethereum will undoubtedly be compelling to observe. Bitcoin’s spot ETF is a significant step towards broader crypto acceptance, but Ethereum’s utility and technological progress establish it as an indispensable player in the digital asset infrastructure. The advent of spot ETFs represents a critical milestone, signifying the maturation of the cryptocurrency market and its integration into conventional financial systems.

To sum up, the launch of the US spot Bitcoin ETF is a transformative event for the cryptocurrency industry, heralding a shift towards mainstream adoption. However, Ethereum is likely to be the primary beneficiary in the forthcoming months, propelled by its robust infrastructure, the anticipated ETF, and the growing recognition of the value of utility and technological innovation in the cryptocurrency sector. Moving forward, the interplay between these dominant cryptocurrencies and the wider financial ecosystem will undoubtedly shape the future of digital assets and global finance.